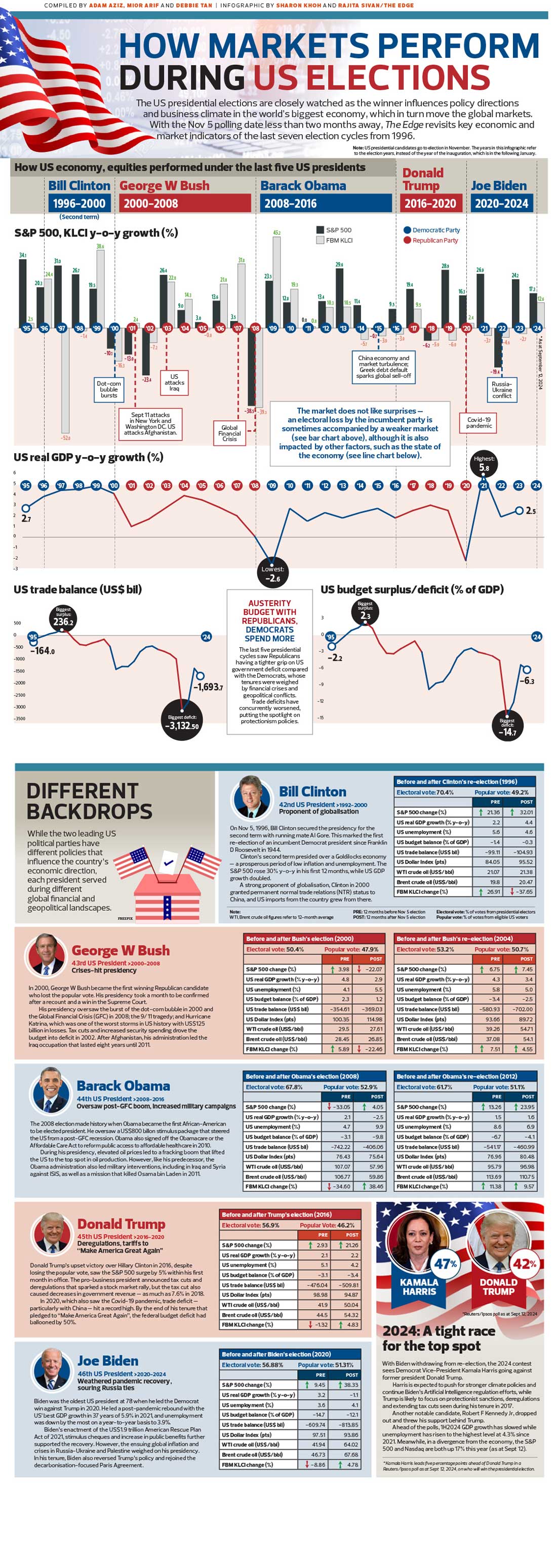

The US presidential elections are closely watched as the winner influences policy directions and business climate in the world’s biggest economy, which in turn moves the global markets. With the Nov 5 polling date less than two months away, The Edge revisits key economic and market indicators of the last seven election cycles from 1996.

How US economy, equities performed under the last five US presidents. Market performance around U.S. elections has historically shown some interesting patterns, often driven by uncertainty, investor sentiment, and expectations regarding the policies of the candidates.

Here’s how markets tend to perform during U.S. election years:

1. Market Volatility

– Pre-election Uncertainty: The period leading up to the election, particularly in the final months, tends to experience increased volatility. Investors are often uncertain about the outcome and the future policy direction, which can create market fluctuations.

– Election Night and Post-Election: The period around election night and the immediate aftermath often sees sharp market movements. If the election outcome is unexpectedly close or contested, markets may react negatively due to uncertainty. However, once a clear winner is determined, markets often stabilize.

2. Historical Performance Trends

– Presidential Election Years: Historically, U.S. stocks tend to perform relatively well during presidential election years. Since World War II, the S&P 500 has posted positive returns in roughly 75% of election years, though the average return is slightly lower than in non-election years.

– Post-Election Rally: After the election results are confirmed, markets can experience what’s known as the “post-election rally.” This rally is often driven by the market’s response to the certainty that comes with knowing the winner, along with optimism about future policies. If the new president’s policies are perceived as market-friendly (such as tax cuts or deregulation), stocks might rally.

– Historical Impact of Political Parties: Some studies suggest that markets tend to perform better under Republican administrations, especially in the immediate aftermath of a Republican victory, although this is not a universal rule. Similarly, Democratic victories can prompt investor caution, but this varies depending on the policy agenda of the elected candidate.

3. Impact of Election Outcomes

Republican vs. Democratic Impact: Markets often react differently depending on whether the winner is a Republican or Democrat.

For example:

– Republican Victories: Typically associated with pro-business, tax-cutting policies, deregulation, and a more robust approach to defense spending. These policies may be seen as beneficial to certain sectors, such as energy, defense, and finance.

– Democratic Victories: Often associated with a focus on social programs, healthcare, and environmental regulations, which can influence industries like healthcare, green energy, and technology.

– Divided Government: If the presidential election results in a divided government (where the president is from one party, but one or both chambers of Congress are controlled by the opposing party), the market may react with a degree of caution. A divided government can result in gridlock, making it harder to pass significant legislation.

4. Midterm Elections

While the focus is often on the presidential election, midterm elections – where all 435 House seats and a third of Senate seats are up for grabs – also have a significant impact on markets. The outcome of these elections can shape market expectations for the next two years, particularly in terms of fiscal policies, government spending, and regulatory changes.

5. Election and Economic Cycles

Elections often coincide with the broader economic cycle. For instance, if the economy is in a strong growth phase leading into the election, investors might react more positively to the incumbent party, while a weak economy could result in market swings as investors adjust expectations regarding how the election outcome might affect recovery or economic policy.

6. Sector-Specific Reactions

Certain sectors tend to react more strongly to the outcome of elections, particularly those related to the candidate’s policy proposals.

For example:

– Healthcare: Health insurance stocks might perform better under a Democratic administration focused on expanding healthcare access, while the same stocks could perform worse under a Republican administration that might focus on reducing regulations.

– Energy: A Republican administration might be more favorable for oil and gas companies, while a Democratic administration might benefit renewable energy stocks due to a focus on climate change and green energy.

Conclusion

While there is no surefire way to predict exactly how the markets will react during any given election, history shows that market performance is highly influenced by investor perceptions, political party policies, and economic conditions. Investors often adjust their portfolios in the lead-up to the election and may make trades based on expected policy changes. However, the post-election period often offers more clarity and direction, which can lead to more stable and optimistic market behavior. In our infographic below we look how US economy, equities performed under the last five US presidents.

![Top 5 Photo Editing Tools for Online Course Creators [Infographic] hero-imae-Top-5-Photo-Editing-Tools](https://www.skillzme.com/wp-content/uploads/2025/02/hero-imae-Top-5-Photo-Editing-Tools-200x200.jpg)

![At a Glance Guide to Relocation to Dubai [Infographic] hero-image-relocation-dubai](https://www.skillzme.com/wp-content/uploads/2024/12/hero-image-relocation-dubai-200x200.jpg)

![Stock Market Changes Through Historical Events [Infographic] Stock Market Changes Through Historical Events](https://www.skillzme.com/wp-content/uploads/2025/02/hero-image-Stock-Market-Changes-Through-Historical-Events-200x200.jpg)

Recent Comments