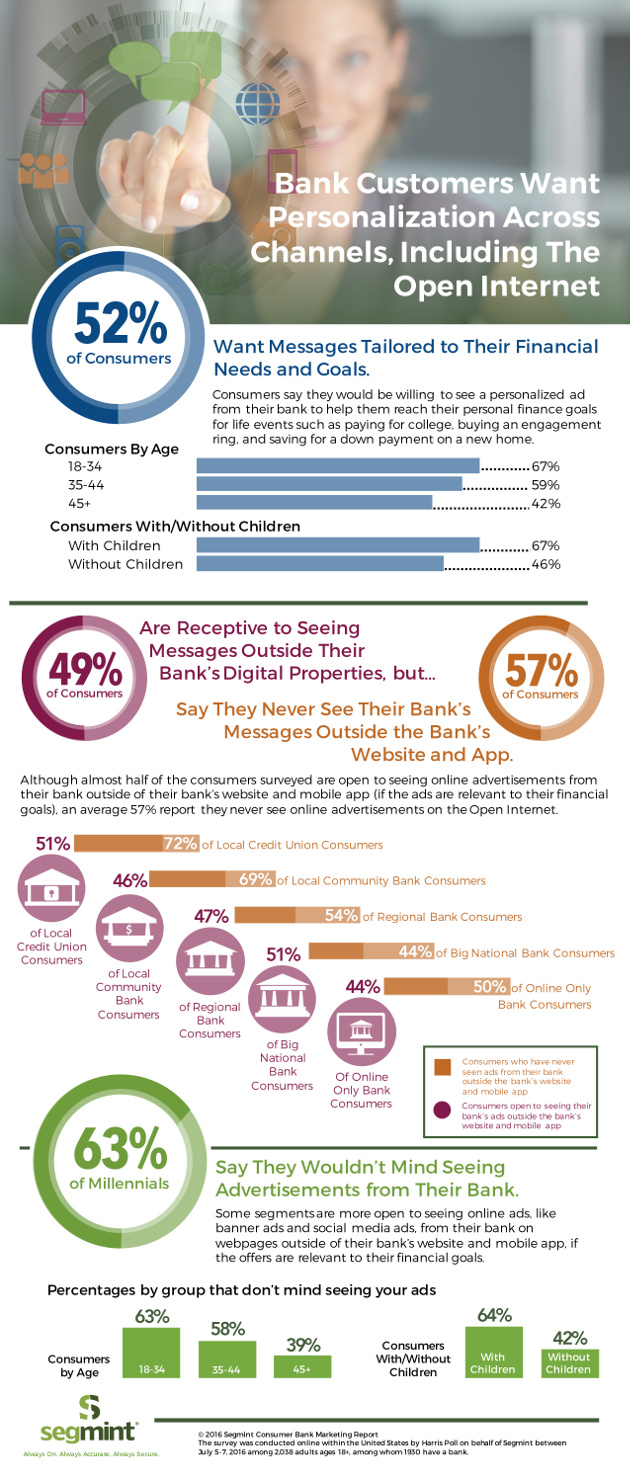

Consumers say they would be willing to see a personalized ad from their bank to help them reach their personal goals for live events such as paying for college, buying an engagement ring and saving for a down payment on a new home. Personalization Across Channels is essential for the bank industry to engage successfully with their clients.

I live for more than 9 years in the Middle East. No surprise when I arrived I was surprised that thousands of people had no bank account. The government of Dubai started back in 2009 to enforce a law that employee need to have a bank account to receive their salary. The effect was that the low income forced the banks to establish systems where a company has one single bank account for a group of people since bank charges would consume all their savings.

Different in the modern world of Europe, America or partial Asia. People see banking necessary of modern life, and it can be an industry without transparency and unwanted fees and services to pay for. As a consumer, we don’t always feel that we spend it the right way or we want just to switch out banking business to another institute. Latest than we realized that loans, credit cards are locking us to the bank which we are not happy with.

Banking is for marketers a paradise on earth to create fantastic cross Omni-channels campaigns.

Upselling, loyalty programs and cross-selling, and savvy marketers in the banking sector know how to speak to their audience of customers.

An infographic based on a report recently published by Segmint highlights what consumers are looking for in their banks’ marketing messages and advertising, and the message is clear: personalization across channels which is the essential part of any successful digital marketing strategy.

Of course, the new generation is pushing as the most important customer segment, nearly 75% of Millennials, and almost the same proportion of people with kids reported that they wouldn’t mind any online and social media ads from their bank if the ad offers are related to their financial goals.

![At a Glance Guide to Relocation to Dubai [Infographic] hero-image-relocation-dubai](https://www.skillzme.com/wp-content/uploads/2024/12/hero-image-relocation-dubai-200x200.jpg)

![Which countries are winning the AI race [Infographic] hero-image-infographic-Digital-Evolution-Series-Part-1](https://www.skillzme.com/wp-content/uploads/2024/11/hero-image-infographic-Digital-Evolution-Series-Part-1-200x200.jpg)

![A Visual Guide to AI Adoption by Industry [Infographic] hero-image-infographic-Digital-Evolution-Series-Part-2](https://www.skillzme.com/wp-content/uploads/2024/11/hero-image-infographic-Digital-Evolution-Series-Part-2-200x200.jpg)

Recent Comments