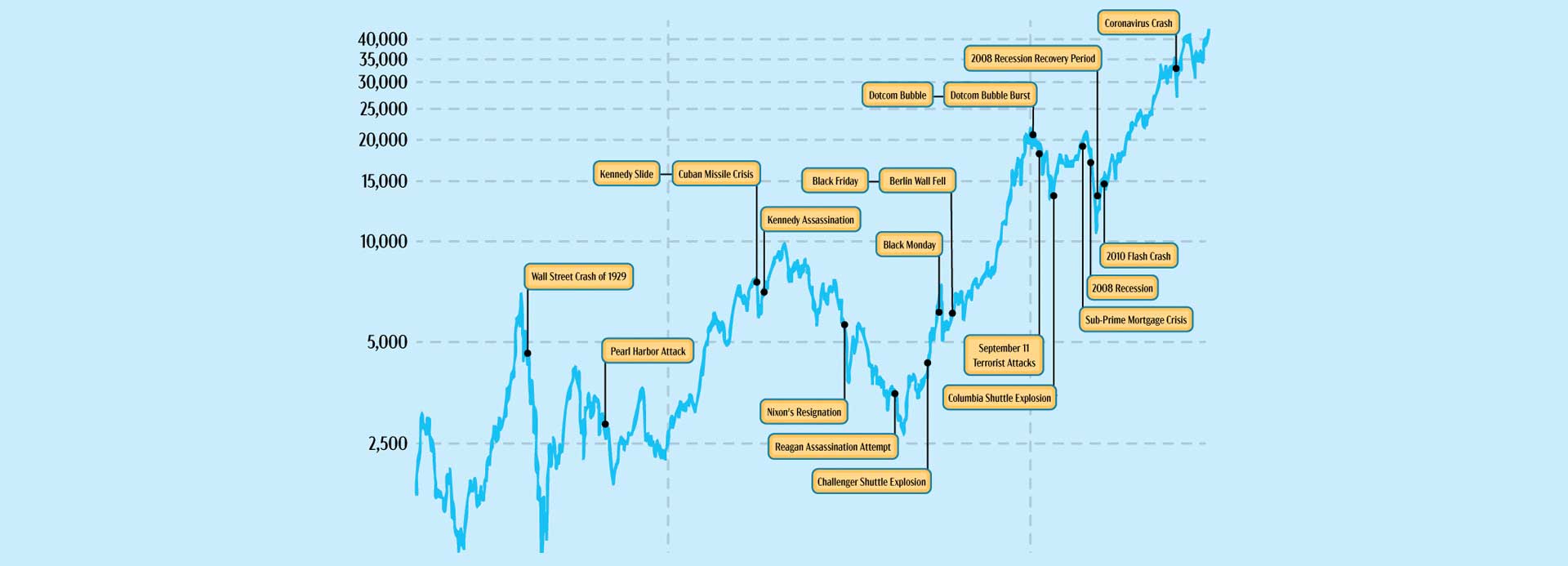

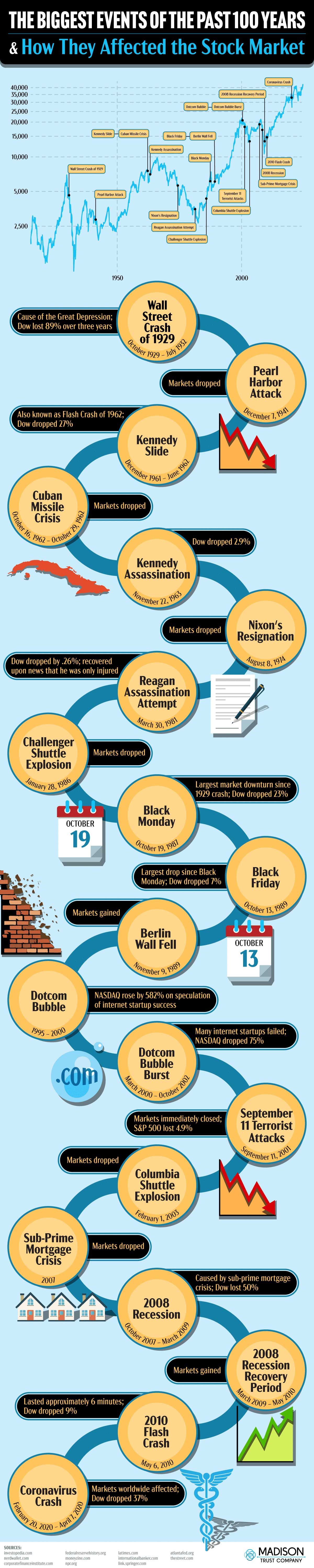

Historical events have a significant impact on the stock market, often serving as a barometer for shifts in global sentiment and economic conditions. Events such as the emergence of new technologies or global health crises can trigger volatility or even lead to long-term market trends.

Stock Market Changes Through Historical Events, for instance, technological advancements, such as the rise of the internet in the 1990s, fueled the dot-com boom, causing stock prices of tech companies to surge, followed by a sharp decline when the bubble burst in 2000. Similarly, the rapid growth of artificial intelligence in recent years has dramatically impacted the stock values of tech giants like Microsoft and Nvidia.

Health crises, such as the COVID-19 pandemic, show how fragile the market can be in the face of global uncertainty. When the pandemic hit, the stock market saw a historic plunge, only to later recover thanks to government stimulus packages and advancements in vaccine development.

Similarly, global conflicts like World War II and the 9/11 attacks also caused major market drops, but the long-term impact varied as economic activities and policies adjusted.

Additionally, recessions and financial crises, such as the 2008 housing collapse, often lead to bear markets, but they can also create opportunities for recovery as economies bounce back. Political decisions, regulatory changes, and trade policies also influence investor behavior and stock performance, making the market a reflection of both current events and investor sentiment.

Throughout history, significant events have had a major impact on the stock market. Whether it’s a global crisis, technological advances, or geopolitical turmoil, the market often reacts in ways that we can’t always predict. Here’s a timeline of some of the biggest events from the past century that shook up the stock market, measured by indices like the Dow Jones Industrial Average, the S&P 500, or the NASDAQ for tech stocks.

The Wall Street Crash of 1929 (October 1929 – July 1932)

The crash in October 1929 caused a dramatic 89% drop in the Dow by 1932. It wasn’t just one factor that caused this; a weak banking system and overvalued stocks played key roles. This event triggered the Great Depression.

The Kennedy Slide of 1962 (December 1961 – June 1962)

This downturn, which dropped the Dow by 27% over seven months, wasn’t due to one clear factor, but speculation about inflated stock prices and waning investor confidence were suspected. The market did bounce back after about 14 months.

Black Monday (October 19, 1987)

Black Monday is a day that investors remember well—a 22.6% drop in the Dow led to a global financial crisis. This prompted the creation of circuit breakers to prevent such extreme drops in the future.

Black Friday (October 13, 1989)

On this day, the market dropped 6.9%, a huge fall after Black Monday. But the Dow rebounded quickly and reached a new record by the following Monday.

The Dotcom Bubble (January 1995 – March 2000)

With the rise of the internet, tech stocks soared, and the NASDAQ surged by 582% in just five years. But eventually, the bubble burst, leading to significant losses.

Dotcom Bubble Burst (March 2000 – October 2002)

When internet startups didn’t live up to expectations, the NASDAQ dropped by over 75%, wiping out $5 trillion in market value. While many startups failed, companies like Amazon and eBay survived and continue to thrive.

September 11, 2001 Terrorist Attacks

The stock market closed immediately after the attacks and didn’t reopen until September 14. When it did, the S&P 500 saw a 4.9% drop. Though the market took a hit, it has since continued to grow.

2008 Recession (October 2007 – March 2009)

The housing bubble burst and the subprime mortgage crisis led to a 51.1% drop in the Dow. The market struggled, and the Great Recession hit hard, but recovery began after a period of time.

Coronavirus Crash (March 2020)

The global pandemic caused a 37% drop in the Dow as panic spread and investors sold off in droves. Circuit breakers were triggered, but the market bounced back with help from government stimulus packages and low-interest rates.

As you can see, major world events have shaped the stock market in ways we could never have predicted. If you’re concerned about how these events might affect your retirement savings, taking control of your investments with a self-directed IRA could give you the flexibility you need to weather any storm.

The recent Days

When big events happen in the world, it’s fascinating how they can show up in the stock market. Whether it’s a groundbreaking new technology or a global health crisis, what’s happening around us often affects how investors behave. Take the rise of the internet in the 90s, for example—it sent tech company stocks soaring, but when the dot-com bubble burst, the market took a serious hit. Fast forward to today, and the surge in AI technology has been a huge boost for companies like Microsoft and Nvidia.

The team at Madison Trust compiled a list of major events and their effects on the stock market.

![The Most Visited Websites in the World, by Category [Infographic] The Most Visited Websites in the World, by Category](https://www.skillzme.com/wp-content/uploads/2025/02/hero-imageThe-Most-Visited-Websites-in-the-World-by-Category-200x200.jpg)

![How Markets Perform during US Elections [Infographics] hero-image-how-markets-perform-during-us-elections](https://www.skillzme.com/wp-content/uploads/2024/11/hero-image-how-markets-perform-during-us-elections-200x200.jpg)

![How EDI has Impacted Different Industries [Infographic] How EDI has Impacted Different Industries](https://www.skillzme.com/wp-content/uploads/2025/02/banner-EDI-Impacted-Different-Industries-200x200.jpg)

Recent Comments